I have seen both yes and no answers to this question, but would like current thoughts or opinions. Apologies if this has been answered elsewhere in this forum but I couldn't find it.

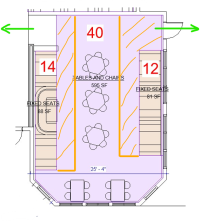

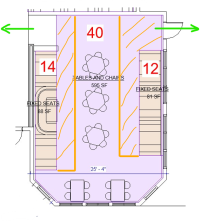

The light purple area In the sketch below would be where the 15 sf / person would apply. The light brown areas are fixed booth seating. The question is could the areas hatched in orange be deducted from the net area for the tables and chairs since this area would need to be always open for exiting from the booths and thus could not contain any tables and chairs, or does the 15 sf/person factor take this into account?

The light purple area In the sketch below would be where the 15 sf / person would apply. The light brown areas are fixed booth seating. The question is could the areas hatched in orange be deducted from the net area for the tables and chairs since this area would need to be always open for exiting from the booths and thus could not contain any tables and chairs, or does the 15 sf/person factor take this into account?