jar546

CBO

The Fiscal and Social Imperatives of Higher-Density Development

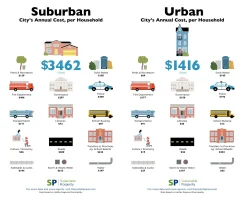

Urban sprawl has become the default development pattern in much of America, but its costs—both fiscal and societal—are becoming impossible to ignore. While suburban expansion may feel like progress, it creates a sprawling web of inefficiency that strains municipal budgets, burdens taxpayers, and depletes natural resources. In contrast, higher-density development offers a path forward, one that not only ensures a more sustainable future but also provides significant economic benefits to communities willing to rethink how and where they grow.Joe Minicozzi, a land-use expert with Urban3, challenges municipalities to “do the math” when it comes to understanding how development patterns impact their bottom line. His research reveals that denser developments, particularly in urban cores, generate far more tax revenue per acre than suburban sprawl. For example, in Asheville, North Carolina, a mixed-use hotel redevelopment downtown produces $634,000 in property taxes per acre, compared to just $6,500 per acre from a suburban Walmart. This stark contrast highlights a critical inefficiency in traditional suburban planning: large, low-density developments require extensive infrastructure and services while contributing far less in revenue.

This inefficiency is compounded by the hidden costs of sprawl. A Smart Growth America study found that sprawl requires 38% more in upfront infrastructure costs and 10% more in annual services. Roads, utilities, police, fire departments—everything stretches thin in sprawling suburbs. Yet, despite the long-standing evidence of these costs (dating back to the federal government’s 1974 "Costs of Sprawl" report), the allure of suburban living continues to drive poor land-use decisions.

Sprawl’s financial fragility was laid bare during the Great Recession. As property values on the suburban fringe plummeted, municipalities found themselves unable to maintain aging infrastructure, let alone fund new services. Like a Ponzi scheme, sprawl depends on continuous new growth to cover past obligations. When growth stops, so does the money. In contrast, smart growth—compact, walkable, and transit-oriented—ensures that communities maximize the return on their most finite resource: land.

Minicozzi’s work, alongside Smart Growth America’s findings, emphasizes that denser development isn’t just fiscally prudent; it’s necessary for survival. Urban infill projects, such as those redeveloping underutilized land within city limits, deliver higher returns per acre while reducing the cost of public services. One case study from Nashville-Davidson County, Tennessee, found that an infill project generated 1,150 times more net revenue per acre than a suburban development. The numbers leave little doubt about what works and what doesn’t.

But this isn’t just about economics. The societal impacts of sprawl are just as damaging. Sprawl encourages car dependency, long commutes, and fragmented communities. It consumes farmland and open space at alarming rates, isolating people from the very amenities that make cities livable. Meanwhile, high-density development encourages connectivity, walkability, and economic vibrancy. Jan Brueckner and Hyun-A Kim’s research on property taxes further underscores this point, revealing how tax policies that penalize dense development inadvertently encourage sprawl. Their findings suggest that switching to land taxes—taxing the value of land rather than its improvements—could reverse these trends, promoting compact, efficient cities.

The case for density becomes even clearer when visualized. Urban3’s GIS models map tax revenue per acre, creating dramatic visuals that show the towering spikes of urban cores compared to the flat plains of suburban sprawl. These models make one thing abundantly clear: the most productive land is almost always in downtowns and transit hubs, not at the suburban fringe. As Minicozzi aptly puts it, “As you’re stacking up stories, you’re stacking up dollar bills.”

Yet, cultural and political resistance to higher-density development remains a significant barrier. For decades, suburban sprawl has been marketed as the American dream. People associate space, cars, and single-family homes with success, while density often evokes fears of congestion and diminished quality of life. But the data tells a different story. High-density living, when well-planned, offers better access to amenities, shorter commutes, and a stronger sense of community—all while lightening the tax burden on residents.

The solution isn’t to eliminate suburban development entirely but to strike a balance. Municipalities need to evaluate the fiscal and environmental impacts of their growth patterns and make informed decisions. This means promoting policies that incentivize infill development, reduce parking minimums, and embrace mixed-use zoning. It also requires educating communities about the long-term benefits of density and dispelling outdated myths about urban living.

The bottom line is simple: sprawl isn’t sustainable. It drains public resources, depletes the environment, and leaves communities financially vulnerable. High-density development, on the other hand, creates resilient cities that thrive economically and socially. As Smart Growth America’s Ilana Preuss puts it, “Every community has the right to decide what kind of development they want,” but those decisions must be made with eyes wide open to the economic realities.

The choice before municipalities is clear. Growing out may have worked in the past, but growing up is the only way forward. It’s time to abandon the false promises of sprawl and embrace the fiscal, social, and environmental benefits of density. The math doesn’t lie—and neither do the results.