Having just returned from a vacation in Europe, I couldn’t help but notice some striking differences in how energy efficiency is approached compared to the United States. From the design of homes and buildings to the integration of renewable energy systems, Europe’s commitment to sustainability is deeply embedded in its infrastructure. This experience left me reflecting on how each region tackles energy codes and the long-term implications of their approaches—not just for the environment, but for their economies and quality of life.

The focus is clear: sustainability is non-negotiable. Everywhere I went, from bustling cities to small towns, energy efficiency seemed woven into daily life. Solar panels dotted rooftops, public transportation was robust and accessible, and even the smallest buildings boasted visible upgrades like modern windows and insulation.

Politically, Europe is largely aligned on this front. While there are outliers, like Poland and Hungary, where economic challenges and a reliance on coal create resistance, most EU nations recognize energy efficiency as both a climate necessity and an economic opportunity. Incentives like subsidies for retrofitting and penalties for non-compliance push progress forward. Even property transactions reflect this commitment—Energy Performance Certificates (EPCs) are required for all sales, ensuring transparency and accountability.

Resistance to energy efficiency is often rooted in political and cultural attitudes. Many states, particularly in the South and Midwest, argue that stricter energy codes increase construction costs, putting homeownership out of reach for many Americans. Critics also view these codes as government overreach. Federal initiatives, like the Inflation Reduction Act (IRA), offer financial incentives for energy efficiency, but without state-level buy-in, their impact is limited.

This fragmented approach has real consequences. States unwilling to adopt energy codes risk higher energy costs and property devaluation over time. The political polarization around energy efficiency means that progress is uneven at best, leaving the U.S. vulnerable to the economic and environmental challenges of an energy-inefficient future.

Health and quality of life also suffer. Inefficient buildings often have poor indoor air quality and inadequate insulation, leading to higher heating and cooling costs and greater risks for vulnerable populations. Moreover, energy-inefficient states are less competitive on the global stage. As Europe enforces measures like the Carbon Border Adjustment Mechanism (CBAM), which taxes imports from countries with lax energy standards, American products from non-compliant regions could face economic penalties.

The U.S. could benefit from a more unified approach. While decentralized governance is a hallmark of the American system, there’s a missed opportunity in the lack of a nationwide energy efficiency strategy. Aligning federal incentives with state adoption could provide the push needed to close the gap between forward-thinking states and those lagging behind.

If there’s one takeaway from my travels, it’s this: energy efficiency isn’t just about reducing emissions. It’s about building resilience, creating economic opportunities, and ensuring a better quality of life for future generations. The U.S. has the potential to lead in this space, but only if it embraces the lessons that Europe has already put into action.

Europe: A Unified, Ambitious Approach

In Europe, energy efficiency isn’t just a guideline—it’s a mandate. The Energy Performance of Buildings Directive (EPBD) requires all new construction to meet nearly zero-energy building (NZEB) standards, meaning buildings must operate with minimal energy use while relying on renewables. Even beyond new builds, Europe is tackling its aging building stock with aggressive retrofitting campaigns under the Renovation Wave, a core element of the European Green Deal.The focus is clear: sustainability is non-negotiable. Everywhere I went, from bustling cities to small towns, energy efficiency seemed woven into daily life. Solar panels dotted rooftops, public transportation was robust and accessible, and even the smallest buildings boasted visible upgrades like modern windows and insulation.

Politically, Europe is largely aligned on this front. While there are outliers, like Poland and Hungary, where economic challenges and a reliance on coal create resistance, most EU nations recognize energy efficiency as both a climate necessity and an economic opportunity. Incentives like subsidies for retrofitting and penalties for non-compliance push progress forward. Even property transactions reflect this commitment—Energy Performance Certificates (EPCs) are required for all sales, ensuring transparency and accountability.

United States: A Decentralized, Divided Landscape

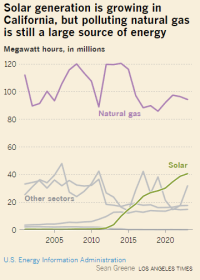

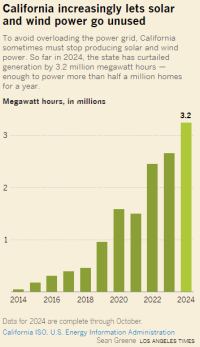

Returning to the U.S., the contrast couldn’t be sharper. While some states, like California and New York, lead the charge with ambitious energy codes, much of the country lags behind. The United States relies on the International Energy Conservation Code (IECC) as a model, but adoption and enforcement are left to individual states and municipalities. This decentralized system creates a patchwork of progress, with some regions pushing forward and others resisting.Resistance to energy efficiency is often rooted in political and cultural attitudes. Many states, particularly in the South and Midwest, argue that stricter energy codes increase construction costs, putting homeownership out of reach for many Americans. Critics also view these codes as government overreach. Federal initiatives, like the Inflation Reduction Act (IRA), offer financial incentives for energy efficiency, but without state-level buy-in, their impact is limited.

This fragmented approach has real consequences. States unwilling to adopt energy codes risk higher energy costs and property devaluation over time. The political polarization around energy efficiency means that progress is uneven at best, leaving the U.S. vulnerable to the economic and environmental challenges of an energy-inefficient future.

The Implications of Inaction

The long-term cost of neglecting energy efficiency is significant. Buildings are a leading source of greenhouse gas emissions, and energy-inefficient homes and offices exacerbate this issue. In regions that resist updating their codes, residents face rising energy bills and reduced property values as the rest of the market shifts toward efficiency.Health and quality of life also suffer. Inefficient buildings often have poor indoor air quality and inadequate insulation, leading to higher heating and cooling costs and greater risks for vulnerable populations. Moreover, energy-inefficient states are less competitive on the global stage. As Europe enforces measures like the Carbon Border Adjustment Mechanism (CBAM), which taxes imports from countries with lax energy standards, American products from non-compliant regions could face economic penalties.

Lessons from Europe

Europe’s approach demonstrates that energy efficiency can be more than an environmental goal—it can be an economic strategy. By combining mandatory standards with financial incentives and clear accountability, Europe has created a framework that not only reduces emissions but also drives economic growth. Property values rise, energy bills drop, and industries related to retrofitting and renewable energy thrive.The U.S. could benefit from a more unified approach. While decentralized governance is a hallmark of the American system, there’s a missed opportunity in the lack of a nationwide energy efficiency strategy. Aligning federal incentives with state adoption could provide the push needed to close the gap between forward-thinking states and those lagging behind.

Moving Forward

My time in Europe left me optimistic about what’s possible when energy efficiency becomes a cultural and political priority. The U.S. has the tools—federal incentives, innovative technologies, and a growing public awareness of climate issues. The challenge lies in bridging the divide between progressive states and those resistant to change. Without a more unified effort, the U.S. risks not only falling behind economically but also facing the mounting costs of energy inefficiency in a world that’s moving rapidly toward sustainability.If there’s one takeaway from my travels, it’s this: energy efficiency isn’t just about reducing emissions. It’s about building resilience, creating economic opportunities, and ensuring a better quality of life for future generations. The U.S. has the potential to lead in this space, but only if it embraces the lessons that Europe has already put into action.